A World with Zero Interest Rates: Implications and Insights

Nov 18, 2024

Imagine a world where money has no time value—a world with zero interest rates. Such a scenario challenges the foundational principles of finance and economics, raising critical questions about its impact on personal finances, businesses, economies, and global financial systems. As some economies flirt with near-zero or even negative interest rates, understanding the implications of this environment becomes increasingly important.

This comprehensive analysis explores the multifaceted effects of zero interest rates, drawing extensively from Japan's long-standing experience with ultra-low rates. We delve into the benefits, risks, and nuances of implementing zero interest rates and examine whether emerging technologies like cryptocurrency could influence this monetary landscape.

The Time Value of Money Revisited

Understanding the Concept

The time value of money is a fundamental financial principle stating that a sum of money is worth more now than the same sum in the future due to its potential earning capacity. Interest rates operationalize this principle by compensating lenders for the opportunity cost of deferring consumption.

Implications of Zero Interest Rates

In a zero interest rate environment:

- Savings Yield Minimal Returns: Traditional savings accounts and fixed-income investments offer negligible interest.

- Borrowing Costs Decline: Loans become cheaper, potentially stimulating investment and consumption.

- Behavioral Shifts: The lack of significant returns on savings may encourage spending over saving, altering consumer behavior.

Impact on Personal Finances

Savings Behavior

- Discouragement of Traditional Saving: With low returns, individuals may be less inclined to keep money in traditional savings accounts.

- Shift to Riskier Investments: Savers might pursue higher returns through equities, real estate, or alternative investments, increasing exposure to market volatility.

- Retirement Planning Challenges: Fixed-income investments are crucial for retirees; zero rates can erode retirement income, forcing adjustments in lifestyle or financial planning.

Borrowing Behavior

- Increased Borrowing Incentives: Lower interest rates reduce the cost of mortgages, auto loans, and personal loans, encouraging individuals to take on more debt.

- Potential for Over-Indebtedness: Easy access to cheap credit may lead to higher household debt levels, posing risks if economic conditions change.

- Asset Price Inflation: Cheap credit can inflate prices of assets like housing, making them less affordable for first-time buyers.

Effects on Businesses

Investment Decisions

- Capital Expenditure Boost: Businesses may take advantage of low borrowing costs to invest in expansion, technology upgrades, or acquisitions.

- Mergers and Acquisitions: Lower financing costs can stimulate corporate restructuring and consolidation.

- Risk of Overinvestment: Companies may invest in projects with lower expected returns due to cheap financing, potentially leading to inefficiencies.

Debt Financing

- Refinancing Opportunities: Firms can refinance existing debt at lower rates, improving cash flow and profitability.

- Increased Leverage Risks: Excessive borrowing due to cheap credit can lead to over-leverage, increasing vulnerability during economic downturns.

- Pressure on Profit Margins: For financial institutions, compressed net interest margins may lead to cost-cutting measures and reduced lending activity.

Profitability and Business Models

- Banks and Financial Institutions: Prolonged low rates can erode profitability, leading banks to increase fees or take on additional risks to maintain earnings.

- Insurance Companies and Pension Funds: Low returns on fixed-income investments challenge these institutions' ability to meet future obligations.

- Alternative Revenue Streams: Businesses may innovate new products or services to offset reduced income from traditional interest-based activities.

Macroeconomic Implications

Impact on GDP and Economic Growth

- Stimulus Effect: Lower interest rates aim to stimulate economic activity by encouraging borrowing, spending, and investment.

- Consumption Patterns: Increased consumer spending can drive economic growth in the short term.

- Long-Term Growth Concerns: If low rates persist without corresponding increases in productivity, long-term growth may stagnate.

Inflation and Deflation Dynamics

-

Inflation Targeting: Central banks often lower interest rates to reach inflation targets, stimulating price increases.

-

Deflationary Pressures: Persistent low rates may signal weak demand, leading to deflation—a general decline in prices—which can hamper economic growth as consumers delay purchases expecting lower prices.

-

The Liquidity Trap:

- Definition: A situation where monetary policy becomes ineffective because people hoard cash instead of spending or investing, despite low interest rates.

- Consequences: Central banks may find it challenging to stimulate the economy, necessitating unconventional monetary policies like quantitative easing.

Currency Valuation

- Exchange Rates: Lower interest rates can lead to currency depreciation, potentially boosting exports by making them cheaper for foreign buyers.

- Capital Flows: Investors may seek higher returns abroad, leading to capital outflows and affecting the balance of payments.

Japan's Experience with Near-Zero Interest Rates

Background

The Lost Decade and Beyond

- Asset Bubble Burst: In the late 1980s, Japan experienced a massive asset price bubble in real estate and stocks. When the bubble burst in the early 1990s, it led to a prolonged economic downturn known as the "Lost Decade."

- Policy Response: The Bank of Japan (BOJ) reduced interest rates to near zero in the mid-1990s to combat deflation and stimulate the economy. This policy has persisted, with rates remaining low for over two decades.

Impact on Personal Finances

Savings Behavior

- High Savings Culture: Traditionally, Japan had one of the highest household savings rates globally.

- Shift in Savings Patterns: With low interest rates, returns on savings accounts diminished significantly.

- Rise in Cash Holdings: Japanese households began hoarding cash, keeping it outside the banking system due to negligible returns—a phenomenon known as "mattress money."

Retirement Challenges

- Aging Population: Japan has one of the world's oldest populations, increasing the dependency ratio.

- Pension System Strain: Low interest rates strained public pension funds, which rely on returns from investments to meet obligations.

- Consumer Spending: Uncertainty about retirement income led to cautious consumer spending, further suppressing economic growth.

Effects on Businesses

Corporate Behavior

-

Survival of Zombie Companies:

- Definition: Firms that generate enough revenue to continue operating but are unable to cover their debt servicing costs.

- Consequence: Low interest rates allowed these companies to survive on cheap credit, preventing the reallocation of resources to more productive sectors.

-

Investment Stagnation: Despite low borrowing costs, corporate investment remained subdued due to weak domestic demand and overcapacity.

-

Cash Hoarding: Japanese corporations accumulated large cash reserves instead of investing or increasing wages, reflecting risk aversion.

Banking Sector Challenges

- Compressed Profit Margins: Banks struggled with low net interest margins, affecting profitability.

- Consolidation: The banking sector saw mergers and acquisitions as institutions sought to remain viable.

- Non-Performing Loans: An increase in bad debts from failing companies burdened banks, leading to tighter lending standards.

Macroeconomic Outcomes

Persistent Deflation

- Deflationary Spiral: Prices continued to decline, leading consumers to delay purchases, expecting further price drops.

- Monetary Policy Limitations: Traditional tools became less effective, prompting the BOJ to implement unconventional measures like quantitative easing and negative interest rates.

Fiscal Policy Responses

- Government Spending: The Japanese government increased fiscal stimulus through infrastructure projects to boost demand.

- Rising Public Debt: Government debt-to-GDP ratio soared above 250%, the highest among developed nations, raising concerns about fiscal sustainability.

Demographic Factors

- Population Decline: A shrinking workforce and declining birth rates compounded economic challenges.

- Labor Market: Increased reliance on part-time and contract workers led to income instability and reduced consumer spending.

Lessons Learned

Effectiveness of Monetary Policy

- Limited Impact Alone: Monetary policy alone was insufficient to revive Japan's economy; structural reforms were necessary.

- Importance of Expectations: Managing inflation expectations is crucial; entrenched deflationary mindset is hard to reverse.

Structural Reforms

- "Abenomics" Initiatives: Former Prime Minister Shinzo Abe introduced a three-pronged approach—monetary easing, fiscal stimulus, and structural reforms—to revitalize the economy.

- Mixed Results: While there were some successes, many structural challenges remained unaddressed.

Cultural and Behavioral Factors

- Risk Aversion: Both consumers and corporations exhibited risk-averse behavior, limiting the effectiveness of low interest rates.

- Savings vs. Spending: Cultural predisposition toward saving over spending hindered efforts to stimulate demand.

Is Zero Interest Rate a Good Thing?

Potential Benefits

- Economic Stimulus: Can encourage borrowing and spending, potentially boosting economic activity.

- Debt Servicing Relief: Eases the burden on borrowers, including governments, businesses, and households.

- Currency Depreciation: May make exports more competitive internationally.

Potential Drawbacks

- Asset Bubbles: Risk of inflating prices in stocks, real estate, and other assets due to excess liquidity.

- Savings Disincentive: Reduces incentives to save, potentially leading to underinvestment in future capital formation.

- Financial Sector Stress: Banks and financial institutions may face profitability challenges, leading to reduced lending capacity.

- Inequality: Asset owners benefit more than those without assets, potentially widening wealth disparities.

Context Matters

- Economic Conditions: Zero interest rates may be more effective in economies with strong demand and investment opportunities.

- Complementary Policies: Fiscal stimulus and structural reforms are often needed to address underlying economic weaknesses.

- Cultural Factors: Societal attitudes toward saving and spending influence the effectiveness of monetary policy.

Implementing Zero Interest Rates: Considerations

Caveats and Nuances

Inflation Expectations

- Avoiding Deflation: Central banks must prevent deflationary expectations from becoming entrenched.

- Communication Strategy: Clear guidance on future policy actions can shape public expectations.

Unconventional Monetary Policies

- Quantitative Easing (QE): Central banks purchase government securities to inject liquidity into the economy.

- Negative Interest Rates: Charging banks for holding excess reserves to encourage lending.

Regulatory Measures

- Macroprudential Policies: Implementing regulations to prevent excessive risk-taking and asset bubbles.

- Capital Requirements: Ensuring banks maintain adequate capital buffers.

Risks

- Diminishing Returns: Prolonged low rates may lead to diminishing effectiveness of monetary policy.

- Capital Misallocation: Easy credit may fund unproductive investments, leading to inefficiencies.

- International Spillovers: Zero interest rates in major economies can affect global capital flows and exchange rates.

The Role of Cryptocurrency

Potential Influence

Alternative Store of Value

- Hedge Against Low Returns: Cryptocurrencies may attract investors seeking higher returns than traditional savings offer.

- Digital Gold: Bitcoin is often referred to as "digital gold," potentially serving as a store of value in times of low interest rates.

Monetary Policy Challenges

- Decentralization: Widespread adoption of cryptocurrencies could undermine central banks' control over money supply.

- Currency Competition: Cryptocurrencies may compete with fiat currencies, complicating monetary policy implementation.

Financial Innovation

- Decentralized Finance (DeFi): Blockchain technology enables new financial instruments and platforms outside traditional banking systems.

- Access to Credit: Peer-to-peer lending platforms using cryptocurrencies could provide alternative financing sources.

Complicating Zero Interest Rate Implementation

Regulatory Considerations

- Regulatory Arbitrage: Cryptocurrencies operating outside regulatory frameworks may introduce systemic risks.

- Consumer Protection: Ensuring investors are protected from fraud and volatility in cryptocurrency markets.

Volatility Concerns

- Price Instability: High volatility of cryptocurrencies may limit their effectiveness as stable stores of value or mediums of exchange.

- Speculative Bubbles: Rapid price increases followed by crashes can lead to significant financial losses.

Integration with Traditional Finance

- Systemic Risk: Interconnectedness between crypto assets and traditional financial institutions could transmit shocks.

- Technological Adoption: Central Bank Digital Currencies (CBDCs) may emerge as a response, influencing interest rate dynamics.

Future Trends and Scenarios

Global Shift Towards Low Rates

Post-2008 Financial Crisis Policies

- Coordinated Easing: Major central banks reduced interest rates to near zero to combat the global recession.

- Persistently Low Rates: Rates have remained low in many developed economies, raising questions about long-term implications.

Demographic Changes

- Aging Populations: Increased savings and decreased investment demand may naturally lead to lower interest rates.

- Productivity Concerns: Slower labor force growth may impact economic growth potential.

Potential Scenarios

Normalization of Low Rates

- New Economic Norm: Societies adapt to a low-interest environment, altering financial behaviors and expectations.

- Structural Adjustments: Businesses and financial institutions adjust models to operate sustainably with low rates.

Policy Reversals

- Inflation Surge: If inflation rises unexpectedly, central banks may need to raise rates rapidly.

- Debt Sustainability Issues: Higher rates could make debt servicing challenging for heavily indebted governments and corporations.

Technological Disruptions

- Fintech Innovations: Advancements in financial technology may change how credit is extended and interest rates are determined.

- AI and Automation: Productivity gains from technology could influence economic growth and interest rate policies.

Preparing for the Future

- Diversified Investment Strategies: Individuals and institutions may need to adjust portfolios to navigate low-return environments.

- Policy Coordination: Greater international collaboration may be required to address global financial challenges.

- Resilience Building: Strengthening financial systems to withstand shocks associated with shifts in interest rate regimes.

Wrap-Up

A world with zero interest rates presents a complex tapestry of opportunities and challenges. While low rates can stimulate economic activity and ease debt burdens, they also carry risks of asset bubbles, reduced savings incentives, and financial instability. Japan's prolonged experience with near-zero interest rates offers valuable lessons on the limitations of monetary policy in isolation and the importance of addressing structural and demographic factors.

The rise of cryptocurrencies adds another layer of complexity, potentially challenging traditional monetary frameworks and requiring careful regulatory oversight. As global economies navigate this evolving landscape, policymakers, businesses, and individuals must thoughtfully consider the implications of zero interest rates, balancing immediate economic needs with long-term financial health.

Understanding the nuances and preparing for various outcomes will be crucial in leveraging the advantages while mitigating the risks associated with a zero interest rate world. Collaborative efforts across sectors and borders may hold the key to managing this unprecedented economic environment effectively.

About VCII

The Value Creation Innovation Institute (VCII) is dedicated to advancing thought leadership in finance, economics, and innovation. We provide insights and analysis to empower decision-makers in navigating the complexities of the modern economic landscape.

#ZeroInterestRates #Economics #PersonalFinance #MonetaryPolicy #Cryptocurrency #VCII #JapanEconomy #GlobalFinance #Innovation #EconomicInsights

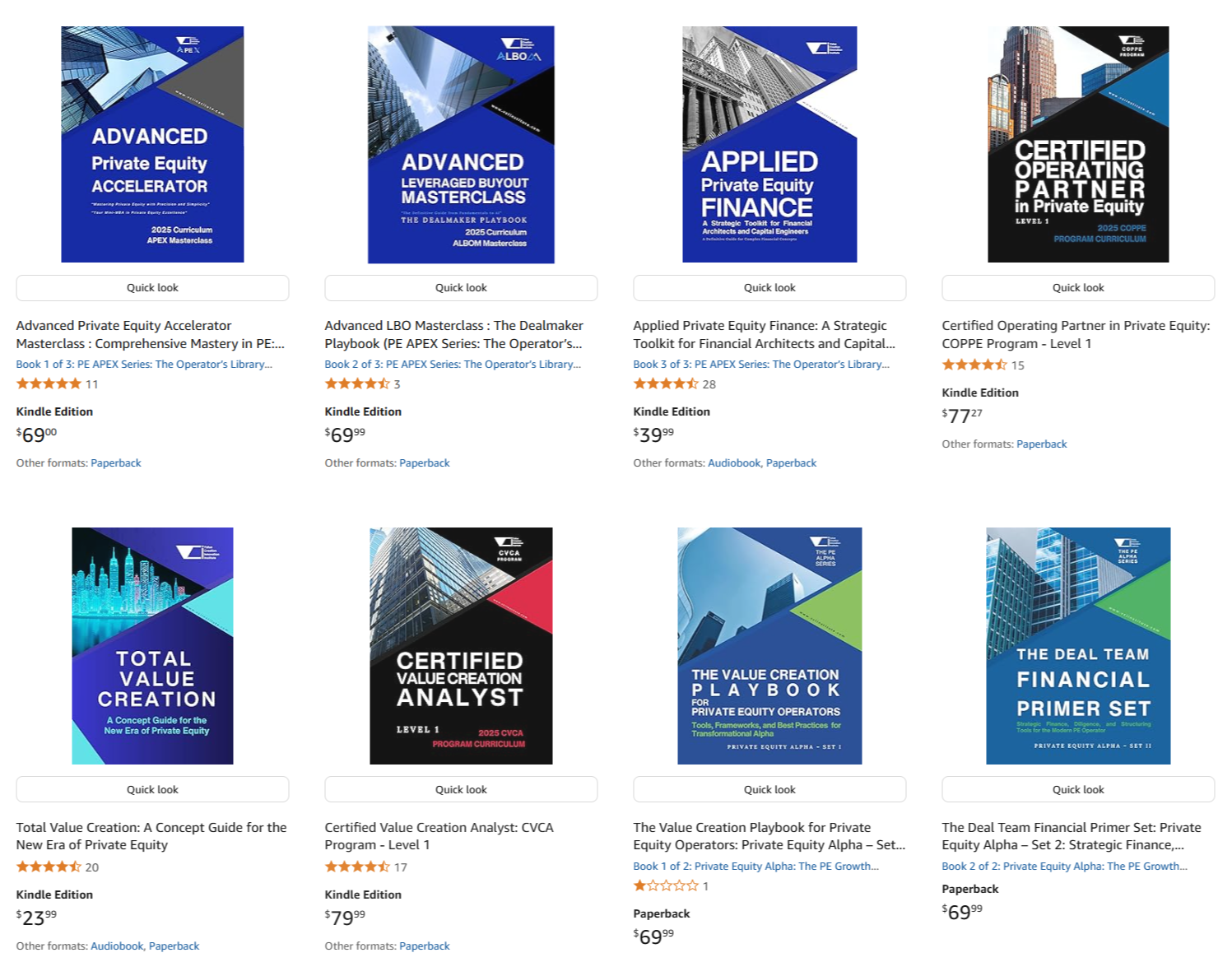

We have many great affordable courses waiting for you!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.