A VCII framework for turning AI from “tools” into repeatable value realization at fund and OpCo levels.

Private equity is entering a cycle where time to liquidity matters as much as underwriting s...

Generative AI has changed the confidentiality equation in private markets. Data rooms were built for controlled access, limited copying, and auditability. AI tools compress, synthesize, and repackage ...

As of January 2026, private equity (PE) is undergoing a profound evolution, propelled by artificial intelligence (AI) from experimental pilots to an embedded operating system. This whitepaper, prod...

Buy and build strategies remain a cornerstone of private equity growth, contributing to a resurgence in deal activity with US$310b announced in Q3 2025 alone, driven by larger transactions and improve...

In the high-stakes world of investment banking (IB) and private equity (PE), talent is the ultimate differentiator. Yet, systemic gaps in recruiting and promotion continue to hinder access, progressio...

Leadership quality at the portfolio level is one of the most decisive, quantifiable drivers of private equity outperformance. When private equity sponsors move beyond intuition and systematize how the...

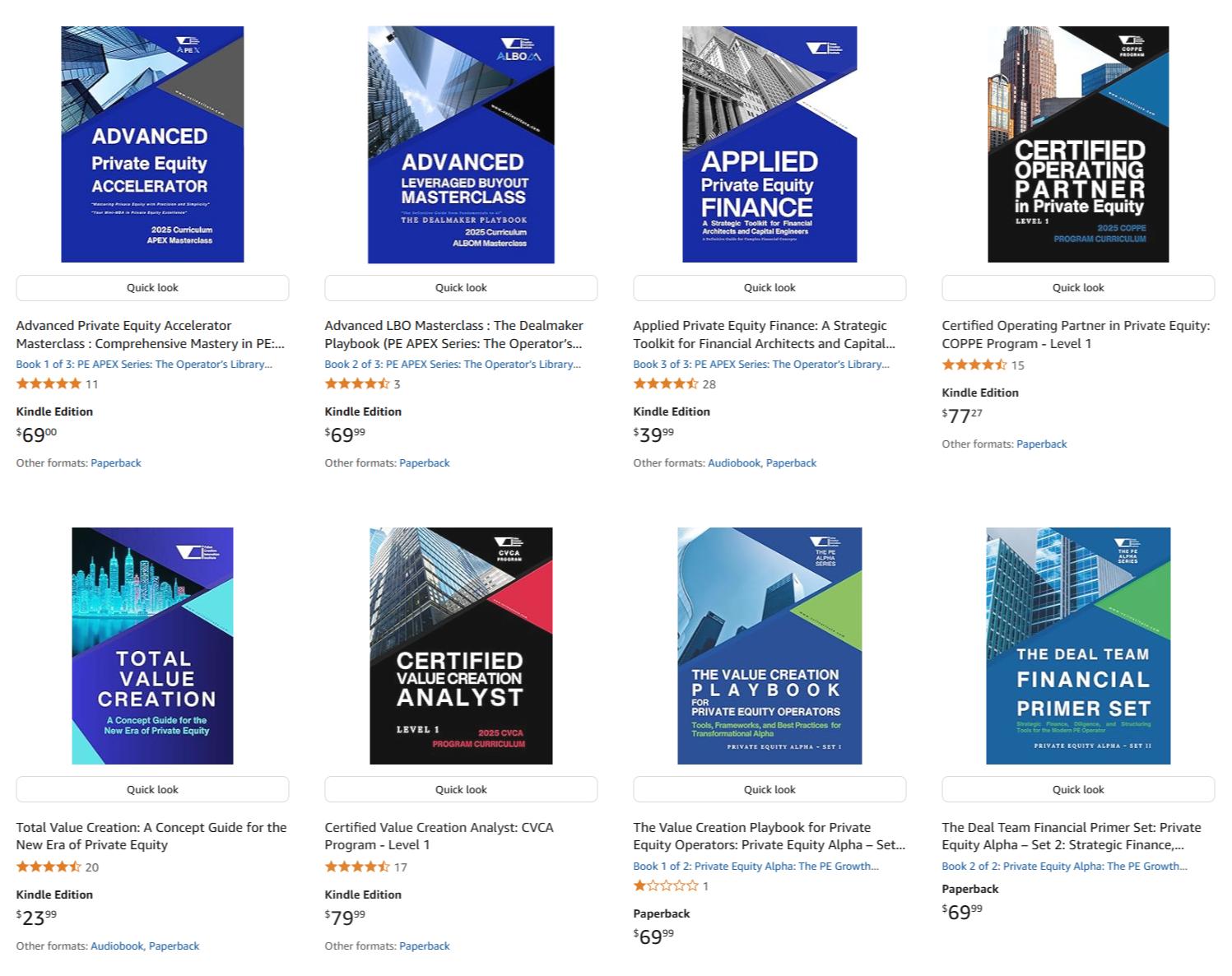

Private equity is at a turning point. While deal teams have long been at the center of firm economics, the true engine of modern value creation has shifted to operations. Today, operating partners are...

Private equity is increasingly burdened by “living-dead” assets: portfolio companies and aging funds that consume capital and attention without delivering growth, liquidity, or meaningful returns. The...

Private equity is confronting one of the most structurally complex environments in its history. The long-standing model of “buy low, lever up, and sell high” has been fundamentally disrupted by persis...

The cadence of global market complexity has accelerated to a point where traditional, reactionary approaches to risk management are functionally obsolete. The confluence of stabilizing interest rates,...

The pursuit of excellence in Private Equity is no longer confined to the relentless optimization of the income statement. The traditional metric for success—the ability to apply financial leverage and...

The fundamental mandate of Private Equity has undergone an existential recalibration. The new paradigm demands that firms evolve from being mere financial engineers to becoming strategic capability cr...

The fundamental contract governing Private Equity is undergoing a necessary renegotiation. The era characterized by reliance on macroeconomic tailwinds and inexpensive debt is drawing to a close. In t...

The modern marketplace for private capital has transcended the simplistic calculus of financial leverage. In an era where Operational Alpha has emerged as the definitive source of superior returns, th...

The architecture of success in Private Equity has entered a new phase defined by complexity and compression. The model that thrived on predictable variables is rapidly losing its potency. In this envi...